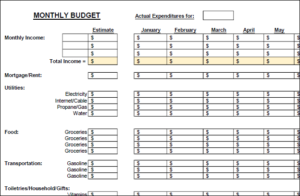

It has been said that …“if you measure something, you can understand it. If you understand it, you can control it, and if you can control it, you can improve it.” The same holds true in your monthly budgeting. This form, based on years of experience, can assist you to keep your finances on track!

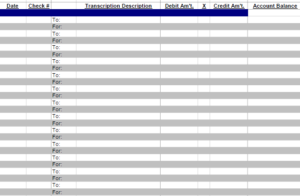

Read More“I can’t be out of money; I still have checks!” To avoid this infamous claim, it is important to know your balances in each and every account, including your sub-accounts.

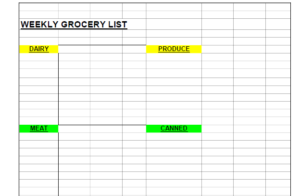

Read MoreWhat is the best way to keep from overspending at the grocery store? Don’t go when you are hungry and always take a shopping list! This avoids breaking your budget on food items.

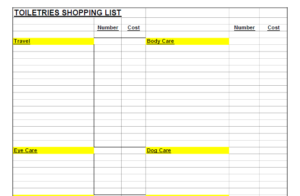

Read MoreHave you had family members say, in passing, “I’m out of XYZ shampoo and I need more tomorrow, please!” This often happens at month end when the budget has already been depleted! By posting this list in a visible spot for the whole family, along with your next shopping date, the accountability for empty items can be lifted off your back!

Read More