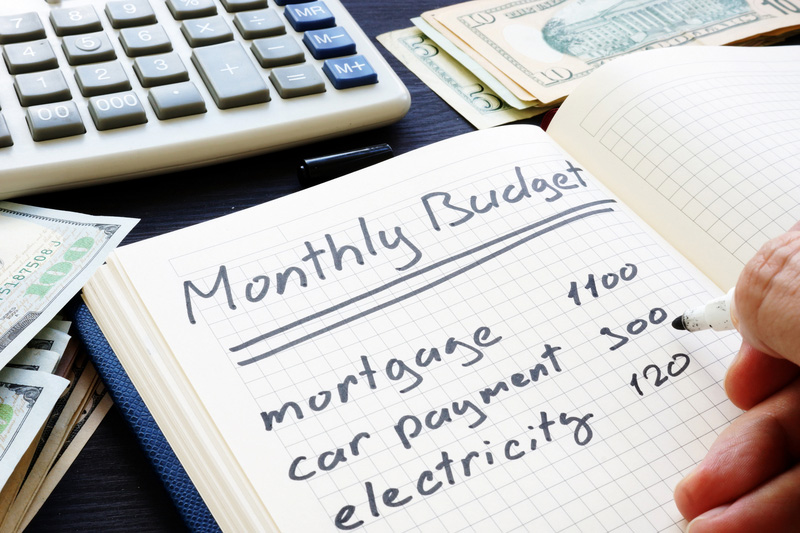

If you have not developed that Monthly Budget, then this conversation is for you!

A “Bare Bones” Monthly Budget can start out quite simply. Here are the steps!

- How much is your family’s total monthly income to cover all expenses? List this at the top!

- Make a list of all your monthly expense categories.

- Rent/Mortgage

- Insurance Premiums/Other Payments

- Contributions

- Savings

- Utilities

- Gasoline

- Groceries

- Toiletries/Vitamins

- Entertainment/Lessons/Sports

- Beside each expense category, first list the monthly payment for those items that cannot be flexible, basically categories a. – e. Go ahead and subtract these dollars from your monthly income and see how many dollars are left.

- Now, it is time to start looking at the flexible categories, g. – i. These can be a huge budget drain if you don’t set some limits. Groceries: what have your total grocery bills averaged the last 3 months? I should say total food bills instead of grocery because eating out fits into this category right now (spending money to buy food for 1 meal that replaces eating at home). Then ask the tough questions. What can I eliminate? Can I buy less expensive food items? Can I shop at a less expensive store? Can I eliminate eating out altogether, or if it is just an occasional treat, can that meal be moved to Entertainment instead of groceries.

- Toiletries/Vitamins is another flexible category. Sure, there are a few necessary items in that group – toothpaste, deodorant, shampoo, laundry soap and toilet paper to name a few. Compare the price of these from store to store before you are set on where you shop for them, then stick to the list! How many of us are tempted to double the item list as we walk through the store? Shop with the family for these items a few times so everyone knows their limits within your budgeted amounts.

- The last big ‘elephant in the room” is that category called Entertainment/Lessons/Sports. This is a tough category to address and budget for. Some of you just need to budget some weekend activity spending money for yourselves, while others of you have children who want to be involved in everything. Whichever group you fit into, remember this is a limited dollar amount. One fun weekend activity per month or one sport/lesson per child may be your budget’s limit.

- The last thing to do, as a family, is to discuss these numbers. Especially if you, right now, have more dollars going out for expenses than you have as total family income. Your goal is for them to balance to zero at the bottom line. If you are not there yet, get input from family members to see what it will take to get to a balanced budget.